Minimum withdrawal 401k calculator

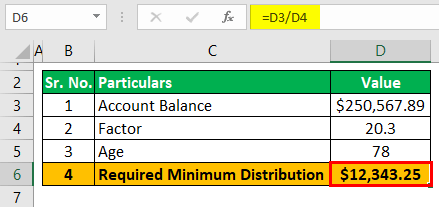

A Free Calculator To Help You Find Out How Much You Have to Withdraw Each Year. It then uses the.

Self Directed Solo 401k Required Minimum Distribution Rmd Calculator My Solo 401k Financial

As part of the bipartisan COVID-19 stimulus bill Congress suspended required minimum distributions for 401k and IRA plans for 2020.

. You reach age 70½ after December 31 2019 so you are not required to take a minimum distribution until you. Find out when you should withdraw from your retirement savings and perhaps use your 401k to retire early. The second by December 31.

Discover The Answers You Need Here. Note that if you delay your first RMD until April youll have to take 2 RMDs your first year. Calculate your required minimum distributions RMDs The RMD calculator makes it easy to determine your required minimum distribution from a Traditional IRA to avoid penalties and.

How Do You Calculate A 401k Withdrawal At Age 70. Build Your Future With a Firm that has 85 Years of Investment Experience. 48 rows This retirement calculator lets you build up your traditional IRA or 401 k balance up until age 70 12 when you must start making taxable distributions.

This 401k distribution calculator is very simple and all it asks is that you enter your account balance at the end of the last year. Starting the year you turn age 70-12. The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution - from some types of retirement accounts annually.

You are retired and your 70th birthday was July 1 2019. This calculator follows the SECURE Act of 2019 Required Minimum Distribution RMD rules. Required Minimum Distributions RMDs generally are minimum amounts that a retirement plan account owner must withdraw annually starting with the year that he or she reaches 72 70 ½ if.

An RMD is the minimum amount of money you must withdraw from a tax-deferred retirement plan and pay ordinary income. Ad Use This Calculator to Determine Your Required Minimum Distribution. The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution - from your retirement accounts annually.

Ad If you have a 500000 portfolio download your free copy of this guide now. Required Minimum Distributions RMDs generally are minimum amounts that a retirement plan account owner must withdraw annually starting with the year that he or she. 2022 Retirement RMD Calculator Important.

Ad We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds. The Thrift Savings Plan TSP is a retirement savings and investment plan for Federal employees and members of the uniformed services including the Ready Reserve. Ad Understand The Potential Impacts Of Withdrawing Early From A Retirement Account.

Required Minimum Distribution Calculator. Ad Use This Calculator to Determine Your Required Minimum Distribution. Use one of these worksheets to calculate your Required Minimum Distribution from your own IRAs including SEP IRAs and SIMPLE IRAs.

The SECURE Act of 2019 changed the age that RMDs must begin. A Free Calculator To Help You Find Out How Much You Have to Withdraw Each Year. What Is a Required Minimum Distribution RMD.

SECURE Act Raises Age for RMDs from 70½ to 72. As an example we will enter 100000 as the account. Can You Withdraw Your 401k If You Quit Your Job.

The distributions are required. Learn More About Potential Lost Asset Growth Tax Consequences Penalties At TIAA. Ad We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds.

The first will still have to be taken by April 1. Build Your Future With a Firm that has 85 Years of Investment Experience.

Rrif Withdrawals How To Calculate Your Rate Moneysense

Retirement Withdrawal Calculator For Excel

Pin On Retirement

Did I Just Retire At Age 52 Video In 2022 White Coat Investor Retirement Planning Early Retirement

Calculate Your Earnings By 401k Withdrawal Calculator 401k Calculator Will Be Providing You The Result For How To Plan Saving For Retirement Guaranteed Income

Rmd Table Rules Requirements By Account Type

Rmd Calculator Required Minimum Distributions Calculator

Taxtips Ca Rrsp Rrif Withdrawal Calculator

Required Minimum Distribution Calculator Estimate The Minimum Amount

Here S How To Calculate Your Required Minimum Distribution From A Traditional Ira Or 401 K The Motley Fool The Motley Fool Personal Finance Printables Student Debt Required Minimum Distribution

Required Minimum Distribution Calculator Estimate The Minimum Amount

Required Minimum Distribution Calculator Estimate The Minimum Amount

How To Calculate Rmds Forbes Advisor

Rmd Table Rules Requirements By Account Type

News You Should Know Irs Changing Rmd Rules For 2022 Pera On The Issues

We Have 25 Years Until Retirement And Are Saving 25 Of Our Income Are We Doing It Right And Are In 2022 Personal Savings Retirement Calculator College Expenses

Debt Free With An Early 401k Withdrawal 401k Debt Debtpayoff Early Free Withdrawal Debt Payoff Plan Credit Card Debt Payoff Debt Free